The coronavirus is dominating the news schedules. It has even shoved the Alex Salmond trial off the headlines, and when a story is so big that the British media are distracted from all their SNPBaaaaad Christmasses come at once, you know it must be serious. Everyone who has a passing interest in Scottish politics was expecting that the Salmond trial would receive wall to wall coverage and no other story would get a look in. But instead it’s been bumped far down the schedules, and it’s easy to miss if you’re not paying close attention. That’s how serious a story the coronavirus is.

So you might think then that when dealing with a gravely serious story that the media, especially a public broadcaster like the BBC, should be finding equally gravely serious experts to inform us about the realities of the epidemic. You know the kind of thing, professors of…

by weegingerdug.scot View original post 1,306 more words

The Rules for Rulers… Adapted from ‘The Dictators Handbook…

British Electoral Commission should not play any part in Scotland’s exercise of its right of self-determination…

Of questions and reframing…

Michael Gove is correct. You won’t see or hear those words very often. And never without some qualification. My own qualifying supplement is that Gove is correct, but only partly, coincidentally and in a sense.

That the British Electoral Commission is wasting its time is true in the sense that, as an agency of the British state, it should have no role in the process that will restore Scotland’s independence. It is also true that the British Electoral Commission is wasting its time in the sense that it is testing the wrong question. But we’ll come back to that.

Given that the British Electoral Commission should not play any part in Scotland’s exercise of its right of self-determination it follows that whatever process the British Electoral Commission is involved in cannot be intended to lead to the restoration of Scotland’s independence…

View original post 2,396 more words

REPOST Reminder … Work & Pensions Secretary Describes Foodbanks as “Perfect” for Poverty…

Work and Pensions Secretary Therese Coffey MP has caused outrage after stating that foodbanks are the “perfect way to try and marry the challenges that people do face in difficult times in the life.” The already unpopular head of the Department and Work and Pensions (DWP) Coffey, was responding to a question from new Labour MP, Zarah Sultana at Work and Pensions questions in the House of Commons.

Work and Pensions Secretary Therese Coffey MP has caused outrage after stating that foodbanks are the “perfect way to try and marry the challenges that people do face in difficult times in the life.” The already unpopular head of the Department and Work and Pensions (DWP) Coffey, was responding to a question from new Labour MP, Zarah Sultana at Work and Pensions questions in the House of Commons.

The latest remarks by the head of the Department for Work and Pensions (DWP) are unfortunately not in the least bit surprising. In the past senior Tory MPs have been keen to either blame foodbank users for the problems, or just ignore why their use is rising and push them as a solution.

During the 2017 General Election campaign, now Foreign Secretary Dominic Rabb was blasted for comments he made on The Victoria Derbyshire Program. Rabb responded to a question foodbank use by saying;

“Look, in terms of the food bank issue, I’ve studied the Trussell Trust data.

“What they tend to find is the typical user of a food bank is not someone who’s languishing in poverty, it’s someone who has a cash flow problem episodically.”

Read more…

A REPOST Reminder of English thuggery … Why Don’t You Fuck Off Back to Scotland?

Tweet

By Jason Michael

What do we learn about Tory England and its Englishness when Conservative MPs are roaring at little girls to get back to their own country? Not much. We just get to see the whole thing for what it really is: Pathetic aggressive thuggery.

Verbal abuse is violence, and can often be every bit as harmful as physical violence. It is important that we are clear on this point before we proceed. James Heappey, MP for Wells in Somerset, made the headlines for telling a Scottish schoolgirl to “fuck off back to Scotland” when he visited her class because she said she would vote for independence if she was given the chance. Not a single report on this incident called this an act of violence. It is time that we set the record straight.

This sixth form pupil at Millfield School in Somerset is Scottish. She lives…

View original post 504 more words

Is federalism a workable solution for Scotland? NOPE!

Many people have asked us “is federalism a workable solution for Scotland?”. Federalism has been discussed for several years and now, with the Scottish Labour Party suggesting it as an alternative to independence, it needs to be considered. We researched the facts and we found the following:

The truth

Federalism requires the agreement of all member-states of the UK, it cannot be implemented by Scotland alone. With a Conservative majority in Westminster that does not back Federalism, such an agreement is highly-unlikely. It’s also worth considering that under Federalism, Scotland’s political power would still be limited by a central government outside of Scotland. Therefore, many Scottish voters would not consider it as an alternative to independence.

The facts

- Federalism involves a mode of political organisation that distributes power between a central authority (e.g. Westminster) and the constituent units (e.g. Scotland, England, Wales and Northern Ireland). These states are granted certain powers, while others are retained by the central government.

- Federalism cannot be implemented in Scotland without the rest of the UK also adopting federalism and this would involve significant constitutional change.

- A recent poll from Panelbase highlights that only 10% of Conservative voters support federalism. Therefore, considering that Westminster holds a Conservative majority, the implementation of federalism is practically impossible.

- It was demonstrated in the 1973 Kilbrandon Commission that there is no federal structure currently that could accommodate England as a separate entity.

- The House of Lords Select Committee on the constitution concluded that: There is no support for federalism within England. This would be essential, as a UK-wide referendum would have to take place to decide whether federalism would be implemented or not.

- Under a federal system, defence (e.g. declaring war) and foreign policy (conducting foreign affairs and agreeing to trade and immigration deals with other nations) would be powers retained by Westminster.

- Other powers, such as those regarding taxation, lawmaking and enforcement, would be shared by the states and the federal government (Westminster).

Verdict? Full independence. Nothing less…

Sorry, nope. Full powers for Scotland that cannot be taken away or ‘adjusted’ over time…

Read more: https://www.believeinscotland.org/is-federalism-a-workable-solution-for-scotland/

Ducks in a row

INDEPENDENCE is not merely a mainstream political idea in Scotland, it is the single most important question in Scottish politics around which all other political discussion revolves.

When the SNP’s Mike Russell announced recently that he was stepping down from Holyrood as he’s approaching retirement age, he remarked that Scotland is closer now to independence than it has ever been. Despite the hand-wringing in certain quarters about a perceived lack of progress in challenging Boris Johnson’s blanket refusal to countenance another independence referendum, Mike was right. Amidst all the gloom and despair about Tory rule, about Brexit, about the coronavirus, about a certain looming trial, Scotland is indeed closer to independence than it has ever been. The independence movement is in a far stronger position than it has ever been, and the institutions of the British state in Scotland are weaker and more discredited than they have ever been. We live in a country which is heading for independence.

The most important reason why Scotland is closer to independence than it has ever been is a reason…

View original post 1,517 more words

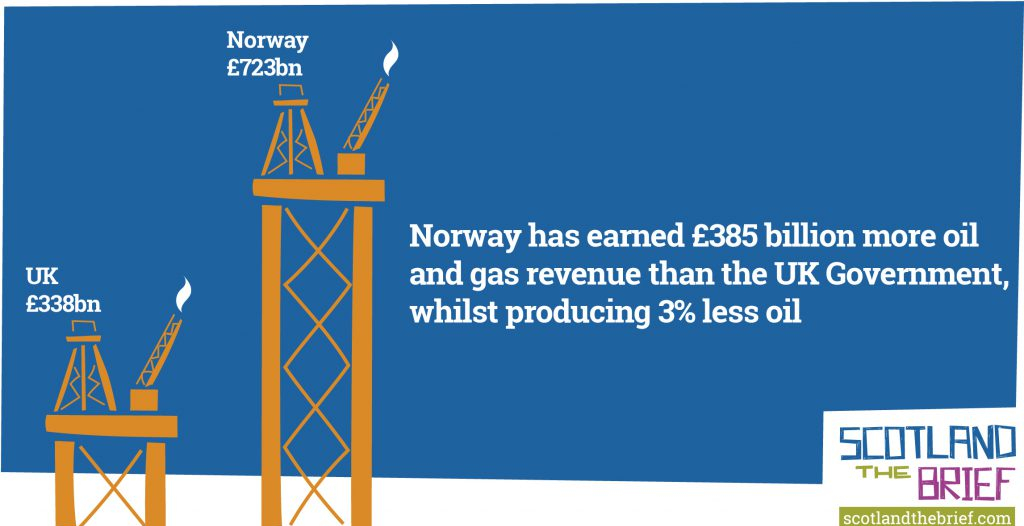

Oil – An epic example of Westminster’s economic mismanagement…

A key argument against independence is the claim that Scotland would be too small a nation to maximise the benefit of its oil industry. However, when comparing the UK and Norway’s oil and gas production, and their revenues generated from this industry, we can see that Norway (a smaller independent northern European nation) has generated £386bn more than the UK Government in tax revenues since the production of oil and gas began. 402 403

If Norway had produced significantly more oil and gas than the UK, this may be understandable. However, this is not the case. Instead, the UK has (to date) produced 1% more oil and gas than Norway overall. 404

A comparative loss of £386bn in tax revenue amounts to a monstrous failure in resource governance by the UK Government. With comparative geologies, original production costs, oil grades, prices and resources, Norway – a country very similar to Scotland in population and geography – has collected a huge revenue windfall, whilst Scotland has not.

We have already explained the cumulative deficit or the share of the rest of the UK’s national debt that has been loaded on to Scotland’s accounts. However, it is worth noting that even with debt loading and the Croydon Principle, Scotland’s indicative deficit in GERS was lower than the UK’s for 33 of the 38 years for which we have figures. So what changed?

The price of oil crashed in 2015. Brent crude averaged $52/b in 2015 after having averaged $98/b in 2014. 405 If the claims that Scotland was dependent on oil and gas were true then Scotland’s economy would have crashed with it.

However, Scotland’s economy did not even enter into a recession. The economic growth for the year was negative, at 0.04%. However, the onshore economy grew 1.6%, according to the GDP figures in the 2015/16 GERS report, as the benefit of lower oil prices boosted the onshore economy. Hardly the armageddon predicted during the independence referendum if oil prices dropped, never mind crashed the way they did.

Contrast that with the collapse of the financial markets in 2007, upon which the UK economy was twice as dependent on as Scotland was on oil. This led to six consecutive quarters of negative growth – in other words, a recession, from March 2008 to July 2009. 406

We now know that the UK Government’s natural resource management track record is dire. Even so, the GERS reports showed a smaller deficit for Scotland than for the UK until the oil crash and the economy stayed pretty much the same from 2014/15 to 2015/16. 407 So why did oil and gas revenues drop to a deficit of £290m in 2016/17, before recovering to £1.25bn in 2018/19? 408

The answer is that the UK Government stopped collecting tax from the big oil companies. In response to falling oil prices, the UK Government decided to cut Petroleum Revenues Tax (PRT) in 2015 from 50% to 35%, and in 2016 it was further reduced to 0%. 409 The supplementary charge was also cut from 62% to 50% to 10% during the same time. 410 This meant that the UK earned less in tax revenue from its oil and gas industry. Despite oil prices rising again and stabilising at between $60.00 and $70.00, and increased production and cost-cutting helping to lower some UK production costs to around $15.00 per barrel, 411 the zero PRT rate means that revenues will not increase in line with oil company profits.

This also means that the illustrative Scottish deficit figure will not reduce as tax revenues are negligible.

This has led to Shell, for example, receiving tax rebates in 2018 from the UK Government of £105.48m. Those show up in Scotland’s GERS report

as a loss on North Sea operations of £105.48m. At the same time Shell paid Norway $3,154m in taxes. 412

That’s good for Shell, a company that remained in profit during the oil price drop, which recorded profits in 2015 of $3.84bn, then $3.5bn, $15.8bn and a massive $21.4bn in 2018. 413 Shell also paid out the world’s highest shareholder dividend in 2015.

It was the oil workers of Aberdeen and the North Sea services companies (more often Scottish owned) that took the hit when the price crashed. The UK Government protected the big oil companies and their shareholders.

From their last sets of accounts, the profits declared by the four biggest oil majors operating in the North Sea were as follows: Shell $21.4bn;

BP $12.7bn; 414 Exxon $20.8bn; 415 ConacoPhilips $6.3bn. 416 The North Sea giants, Shell and BP, are now more profitable than they were before the oil price crash and have received billions in tax cuts and credits between them.

Maybe it’s now time to start phasing in the taxes again and investing the profits in renewable energy projects? This, of course, would return Scotland’s finances to the default setting of “significantly better than the UK’s”.

So, the UK Government’s decision to significantly reduce tax on oil companies has had a major impact on Scotland’s national accounts, leading them to show a larger fiscal deficit than the rest of the UK. Since 2015, £1.822bn has been lost from PRT alone. 417

This support to large oil companies (whether necessary, advisable or otherwise) was managed through tax rebates, which have effectively wiped out Scotland’s North Sea revenues. Around 60% of the cost of the PRT cut is deducted from Scotland’s accounts in GERS, which cost Scotland around £340m in 2017/18. 418

To make this clearer, when the UK Government lowers a set of revenues which is almost completely attributed to Scotland as a region of the UK, there is a major reduction in tax revenues assigned to GERS.

On the other hand, if the UK Government had maintained tax levels but then offered grants from the Treasury retrospectively for decommissioning and exploration, then only a population percentage (8.4%) of the costs of that grant support would have been deducted, and the illustrative deficit in GERS would be been smaller than the UK’s – not larger.

Conclusion

The UK’s oil wealth was shared on a population basis across the UK, meaning Scotland received approximately 9% of that wealth. However, the cost of decommissioning is being met solely by Scotland on a geographic basis. This starved Scotland of investment when it needed it most in the 1970s and 1980s and now creates a false deficit which is used as the key argument against Scottish independence.

If Scotland had kept a geographic share of its oil wealth it would be £508 billion better off than GERS suggests it is now 372.

Oil – An epic example of Westminster’s economic mismanagement

Child Rights – Britain plunges from 11th to 170th in just two years…

Britain is circling the plughole. So many things are wrong on so many levels it’s difficult to know where to start. After the banks crashed the economy, austerity followed. One £trillion was added to the national debt. Half was thrown down the drain to appease banks that were threatening financial armageddon if they were not bailed out. The other half was thrown at the economy to stop an economic disaster that would have resulted in riots across the country. Ten years later, an austerity ravaged country is almost on its knees. And now this. There is now a crisis everywhere you look. The NHS, housing and homelessness, policing, disabled, the vulnerable – it goes on and on. Austerity inflicted deep cuts to local authorities who, in turn, were forced to cut social care. The yawning gap between demand and supply gets wider each year. And the social care crisis starkly demonstrates that Britain is unable to look after its elderly. At the other end of the struggle of daily life is another section of our society that is now in free-fall. Read more: https://truepublica.org.uk/united-kingdom/child-rights-britain-plunges-from-11th-to-170th-in-just-two-years/

WESTMINSTER is completely broken and SCOTLAND must NOW move fast to get away from their grip on our country…

SCOTS MUST TAKE OUR COUNTRY BACK - 2020

Brexit will have soon cost the UK more than all its payments to the EU over the past 47 years put together

Brexit is set to have cost the UK more than £200 billion in lost economic growth by the end of this year — a figure that almost eclipses the total amount the UK has paid toward the European Union budget over the past 47 years.

Brexit is set to have cost the UK more than £200 billion in lost economic growth by the end of this year — a figure that almost eclipses the total amount the UK has paid toward the European Union budget over the past 47 years.

According to research by Bloomberg Economics, the cost of the UK’s vote to leave has already reached £130 billion, with a further £70 billion likely to be added by the end of 2020.

The analysis, by the economist Dan Hanson, found that business uncertainty had caused the UK’s economic growth to lag behind that of other G7 countries since the 2016 vote.

That means the British economy is 3% smaller than it might have been if the UK had not voted to leave the EU.

Figures from the House of Commons Library put the UK’s total projected contribution to the EU budget from 1973 to 2020 at £215 billion after adjusting for inflation.

That means the combined cost of Brexit since 2016 is likely to soon eclipse the total cost of the EU’s budget payments, which were a central part of the Leave campaign’s case for Brexit in the first place.

Business confidence and investment has dipped, and annualized economic growth has fallen to about 1% from 2%.

“As the UK comes to terms with its new trading relationship with the EU and grapples with the productivity challenge that has hindered growth since the financial crisis, the annual cost of Brexit is likely to keep increasing,” Hanson said.

Source: https://www.businessinsider.com/brexit-will-cost-uk-more-than-total-payments-to-eu-2020-1

y and the UK have managed their oil and gas industries very differently, resulting in a substantial contrast of fortunes in their economies.

y and the UK have managed their oil and gas industries very differently, resulting in a substantial contrast of fortunes in their economies.